HR Policy’s Center On Executive Compensation released “The SEC’s Pay for Performance Rule: a Compliance Guide” for Center members, with decision points that companies and Compensation Committees will need to make. The Center will host a webinar titled SEC’s Pay for Performance Rule: Implications and Watch-Outs for Center members on October 4 at noon ET to review the considerations and potential implications of how the relationships between pay and performance are explained.

The Center was cited 69 times in the final rule and was influential in the SEC’s decision to omit “pre-tax net income” as a required measure, which would have been harmful and misleading. The SEC’s press release is here, along with the final rule and fact sheet.

Below are key requirements of the disclosure:

- The disclosure will be required in proxies for fiscal years ending on or after December 16, 2022 – meaning 2023 proxies for calendar-year companies.

- Companies must provide three years of data for the first disclosure, adding another year of data every year until the full requirement of five years of data is met.

- Required information includes:

- Summary Compensation Table Pay for the CEO and average NEOs;

- Compensation Actually Paid for the CEO and average NEOs;

- The SEC created a new definition of pay for this disclosure, which involves replacing the change in value of pension with service and prior service costs, and replacing grant-date equity values with an annually calculated “fair value” figure as of year-end. This will involve some complicated calculations, as performance shares must be valued using a Monte Carlo or similar method while options will have to be revalued using Black-Scholes or a lattice model.

- The SEC created a new definition of pay for this disclosure, which involves replacing the change in value of pension with service and prior service costs, and replacing grant-date equity values with an annually calculated “fair value” figure as of year-end. This will involve some complicated calculations, as performance shares must be valued using a Monte Carlo or similar method while options will have to be revalued using Black-Scholes or a lattice model.

- Cumulative TSR for the company and its peer group;

- Company net income;

- The “most important financial measure” the company uses to link pay and performance;

- Description of the relationship between each financial measure above and CEO and NEO pay, along with the relationship between company and peer TSR; and

- A list of 3-7 financial metrics that the company determines “most important” – non-financial metrics may be included if they are deemed “most important”

- Summary Compensation Table Pay for the CEO and average NEOs;

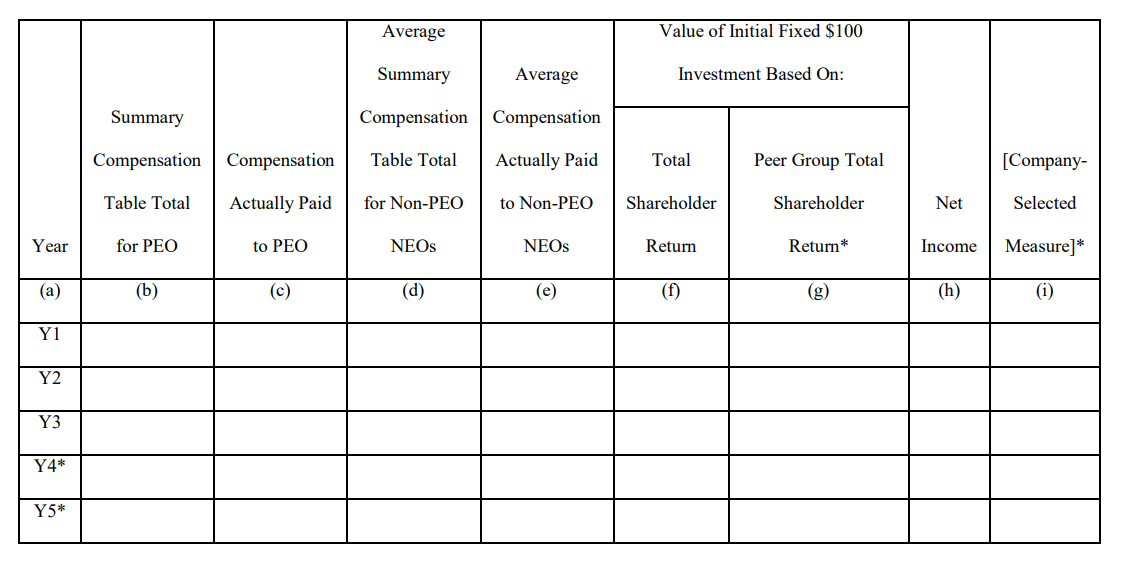

Finally, the information must be provided in the following table:

This is the first of the SEC’s promised rules for the fall – we are still expecting the new human capital metrics rule and the final clawbacks rule in October. HR Policy members are welcome to join us at the Center’s Annual Meeting this November 16 to learn more.

Megan Wolf

Director, Practice, HR Policy Association and Center On Executive Compensation