The SEC released a final rule on pay for performance disclosures on Thursday, much to the surprise of stakeholders, as the rule was not expected until the fall. The vote was evidently done “by seriatim,” meaning it was circulated to each Commissioner in turn with no publicly announced meeting.

The press release is here, with the final rule and fact sheet linked alongside. The Center was cited 69 times and was influential in the SEC’s decision to omit “pre-tax net income” as a required measure, which would have been harmful and misleading.

We are still reviewing the 234-page document and will provide an executive summary and compliance guide to Center members soon. In the meantime, here are the nuts and bolts of the rule:

- The new disclosures will be required in proxies for fiscal years ending on or after December 16, 2022 – which appears to indicate they will be required in 2023 proxies for calendar-year companies.

- Companies will have to provide three years of data for the first disclosure, adding another year of data in each of the following two years until they hit five years of data.

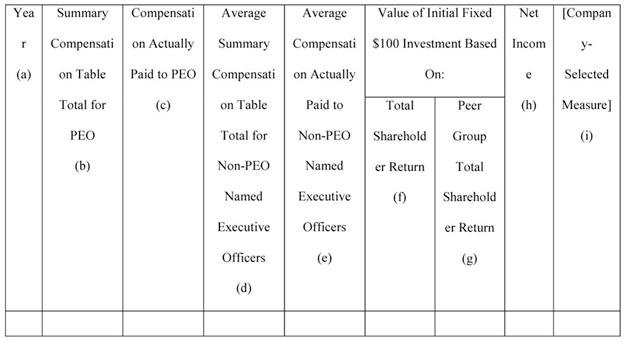

- Required informationwill include:

- Summary Compensation Table Pay for the CEO and average NEOs

- Compensation Actually Paid for the CEO and average NEOs (see below)

- Cumulative TSR for the company and its peer group

- Company net income

- The “most important financial measure” the company uses to link pay and performance

- Narrative description of how each financial measure above is tied to CEO and NEO pay

- Description of the relationship between company TSR and peer TSR

- A list of 3-7 financial metrics that the company determines “most important” – non-financial metrics may be included if they are deemed “most important”

- Definition of Compensation Actually Paid:

- Start with Summary Compensation Table Pay

- Deduct the aggregate change in the actuarial present value of pension

- Add back service cost and prior service cost

- Deduct the value of equity awards as disclosed in the SCT

- Add back equity grantsvalued as follows:

- Year-end fair value in the year of grant

- The amount of change, recalculated every year, until vest

- Dollar value of dividends paid

The new definition of “Compensation Actually Paid” is particularly complex and does not provide needed information on how performance grants are to be valued and revalued, among other things. We will be developing a list of questions for SEC staff on this and other confusing provisions.

Finally, the information must be provided in the following table:

This is the first of the SEC’s promised rules for the fall – we are still expecting the new human capital metrics rule and the final clawbacks rule in October. Join us at our Annual Meeting this November 16 to learn more.

Ani Huang

Senior Executive Vice President, Chief Content Officer, HR Policy Association

Contact Ani Huang LinkedIn