Published on: January 29, 2024

Authors: Dr. Charles G. Tharp, Ani Huang

Topics: Corporate Governance, Executive Pay Legislation and Regulation, Executive Pay Plan Design

CHRO GUIDE

Balancing Purposeful Complexity & Greater Simplicity in

Pay Design

"Where We Are, How We Got Here"*

Executive Summary

Over the past few decades, there has been an explosion of criticism of CEO compensation, particularly in the wake of the 2008 financial crisis. The so-called “quantum” level of executive compensation, the apparent lack of a strong correlation between executive pay and performance (often expressed as returns to shareholders), and the correlation between rising pay and wealth disparity have been the main targets of criticism. Many legislative and regulatory measures put forth by critics (see Appendix for a thorough analysis) have significantly increased the complexity of pay and transparency.

Efforts to lower executive pay or strengthen the link between pay and performance have only increased complexity without actually addressing the issue.

To date, these initiatives do not appear to have lowered executive pay or altered the opinions of those who argue that pay and performance are too loosely linked. A new strategy dubbed “simplification” is emerging in response to the perceived inability to restrain executive pay. On the one hand, proponents of the current structure make a strong case that, given all the goals that businesses are required to accomplish, any complexity that does exist is needed and intentional. On the other hand, this may be an opportunity to challenge ourselves and explore alternative ways to structure executive pay.

In other words, the time may be ripe for new thinking and experimentation in the design of executive incentives.

There are three prevailing viewpoints when it comes to simplification:

1. “If it ain’t broke, don’t fix it.”

2. “Radical simplification.”

3. “Executive compensation isn’t broken, but aspects of it should change.”

First, let’s delve quickly into the evolution of pay design: how we got here and why pay plans are so complicated. Then we will review the major voices calling for simplification, a company example of simplification in practice, and the questions management and the Compensation Committee should be asking to assess if simplification is right for their company.

Evolution of Executive Pay Design

The evolution of executive compensation has been influenced by several factors, including:

- Market competition for executive talent

- Increased size and complexity of companies

- Legislative and regulatory changes

- Investor and proxy advisory firm policies

- Calls for including non-financial incentive metrics based on environmental, social and governance objectives.

Critics of executive pay have pushed through a number of initiatives designed to address perceived concerns with executive pay.

Why have these initiatives failed to produce the desired result? They do not consider the dynamics of supply and demand in the market for executive talent. Indeed, increased disclosure means increased transparency of pay for executive talent – which means boards are obligated to make pay as competitive as possible to attract, motivate and retain the requisite talent to lead large, complex, global companies.

Regulation and legislation have significantly increased the level of

complexity around plan design and disclosure.

In fact, in the end, the plethora of regulation and legislation around executive compensation have only increased the level of complexity, both in plan design and disclosure.

Sources of Increased Complexity: Design and Disclosure

INCENTIVE DESIGN

The forms of annual and long-term incentives that comprise the typical mix of executive compensation are increasingly complex. They span different time periods, use a mix of internal and external performance metrics and may vary among named executive officers (e.g., mix of corporate-wide and single division metrics).

DISCLOSURE

Mismatch in definitions of pay and performance. Most companies award long-term incentives on a forward-looking basis. That is, the final value of the incentive is contingent upon the accomplishment of forward-looking financial objectives and growth in stock price, and the company’s assessment of the pay for performance linkage is conducted at the end of the performance period when results are known and the awards earned and vested.

By contrast, investors and proxy advisors typically assess the pay for performance linkage by comparing Summary Compensation Table reported total pay, which is in large part the current estimated expense of long-term incentives that may or may not be earned at some future date, with total shareholder return over the prior 3- to 5-year time frame. This mismatch of time frames for assessing performance and the use of the Summary Compensation Table measure of pay at date of grant, rather than the pay realized at the end of the performance period, adds to the complexity of assessing pay for performance.

Supplemental Pay Disclosures. Due to the failings of the Summary Compensation Table, companies have developed and disclosed supplemental measures of pay, primarily realizable and realized pay, to help investors understand the pay for performance linkage. As if this were not complex enough, the SEC has now required yet another version of pay to be disclosed, “Compensation Actually Paid,” as part of its 2022 Pay Versus Performance rule.

Proxies Too Long. A 2015 study¹ by Equilar, RR Donnelley and the Stanford Graduate School of Business found that 55% of investors thought the typical proxy was too long, resulting in the average investor only reading 32% of the proxy. Since this study was conducted in 2015 the length and complexity of the proxy has increased significantly due primarily to additional mandated disclosures.

Company-Specific Names. The same form of award may have different names across companies (e.g., for short-term incentives, “Performance Incentive Plan,” “Management Incentive Plan,” “Key Incentive Compensation Plan,” and for long-term incentives “Performance Shares,” “Performance Units,” “Restricted Performance Shares of Units,” “Growth Shares,” etc.) thereby making the comparison of pay programs difficult for investors to decipher.

Purpose Behind Each Element of Complexity

“If it ain’t broke, don’t fix it.” The current structure of executive compensation does what it is supposed to do. The complexity is purposeful and designed to accomplish necessary objectives.

Complexity is purposeful and each element is necessary. The evolution of executive compensation design and disclosure represents an effort by compensation committees to bridge the expectations of external stakeholders and regulators with company objectives. The combination of these considerations has contributed to a degree of purposeful complexity in the design of executive pay programs.

OBJECTIVES

Long-term incentive programs are designed to accomplish the following objectives:

- Encourage a long-term perspective;

- Combat short-term decision-making that may undermine sustained value creation;

- Address the agency problem inherent in the separation of ownership and management of the modern corporation (long-term incentives are predominately equity-based awards which align the interests of management with those of shareholders);

- Achieve favorable accounting expense treatment (i.e., to favor awards that have “fixed accounting” based on grant date value rather than awards that require mark-to-market accounting); and

- Ensure ongoing alignment with shareholders beyond the performance period of the incentive award (often through use of share retention requirements and ownership guidelines).

FORMS OF EQUITY

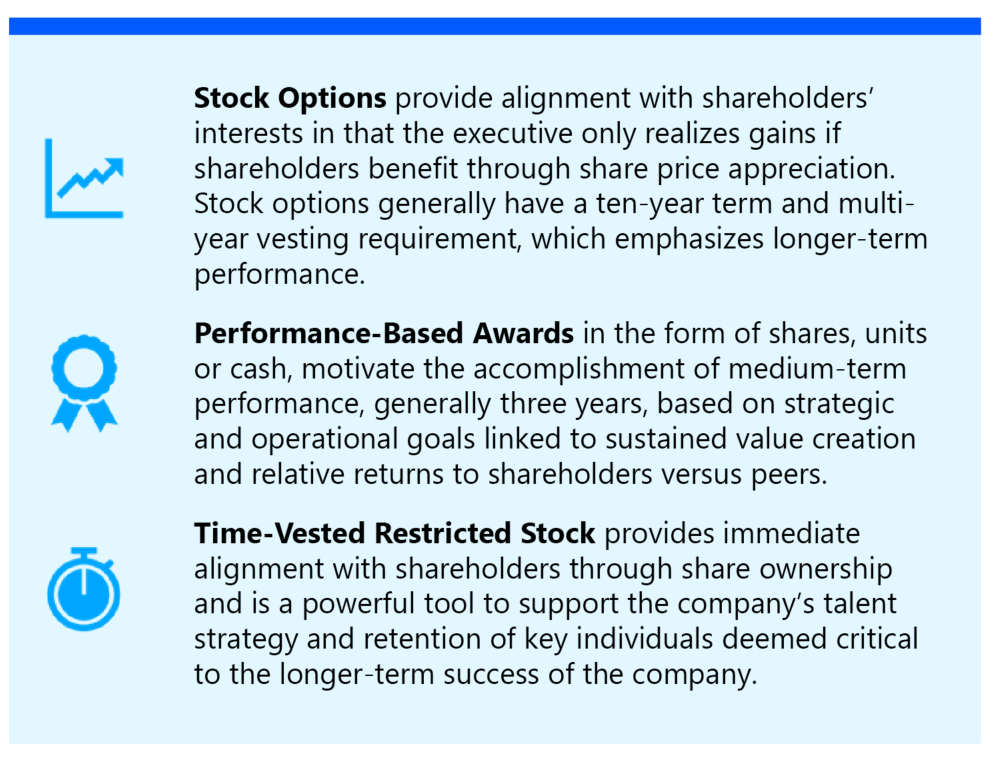

Companies often grant two or three forms of equity (generally stock options, performance shares and time-vested restricted stock) to reinforce different aspects of performance.

PERFORMANCE METRICS

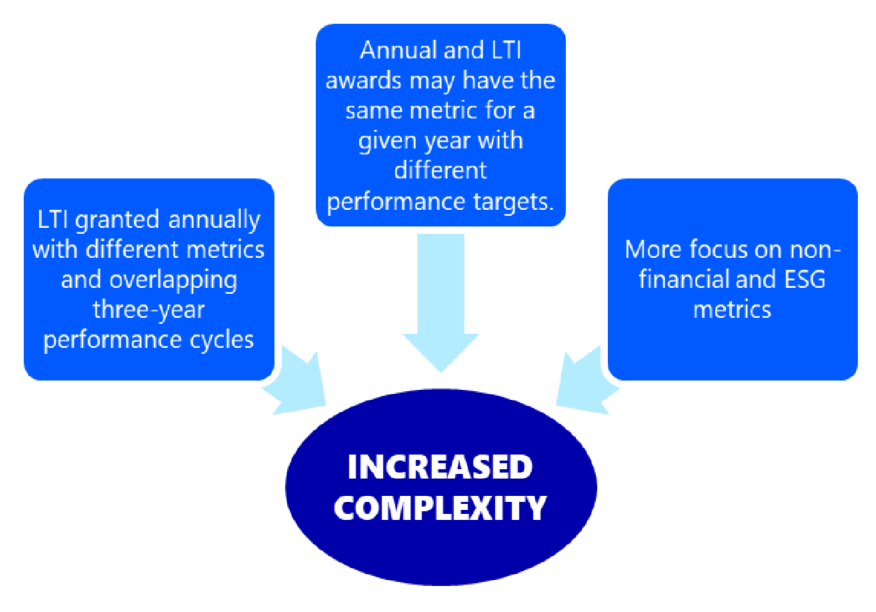

Metrics generally vary between annual awards and long-term incentives to reinforce differing aspects of operational and strategic goals and investor expectations. Further, given the prevailing practice of annually granting long-term awards that have overlapping performance periods with prior awards, there may be differing performance objectives for overlapping performance periods in recognition of a changing competitive or economic context prevailing at the time of each annual award.

COMPANY GOALS

Metrics are expected to reinforce both the level of performance, such as revenue growth, and the quality of performance, such as return on investment. To reward competitively superior performance, some metrics may be measured relative to peers or industry index, while other metrics may be measured based on an absolute target to reinforce achievement of budget or strategic objectives.

INVESTOR EXPECTATIONS

Companies are challenged by differing investor and proxy advisor requirements for performance metric selection. For example, ISS focuses primarily on relative TSR to an ISS-defined peer group, while Glass-Lewis assesses performance based on both TSR and four standard financial metrics. Investors also differ - some favor profit measures while others prefer growth measures, measures of the product pipeline, or return measures in their evaluation models.

In view of these differences in focus, it is not surprising that while companies have invested significant resources in communicating the purposes behind the complexity of incentive arrangements, investors continue to express frustration with the perceived lack of clarity of the pay for performance linkage of executive pay.

Calls for Simplification

“Radical simplification.” The current approach to designing executive compensation is outdated and not serving the interests of stakeholders. Alternative approaches such as eliminating performance shares or equity incentives altogether should be considered.

Critics assert that the current structure of long-term incentives is unnecessarily complex and that the multiple forms of incentives and performance metrics have contributed to the rise in executive pay, thereby prompting calls for simplification of program design. The challenge for companies is to determine if there are ways in which compensation programs may be simplified without jeopardizing the objectives underlying the purposeful complexity of current executive compensation design.

The current structure of long-term incentives is unnecessarily complex.

Further, it is important that companies engage with investors to understand the extent to which complexity is truly the driver of concerns over the current structure of long-term incentives, if the underlying motivation for simplification is an effort to rein in pay rather than reduce complexity, or whether investors have multiple objections to current executive compensation designs.

Vocal examples of this viewpoint include Norges Bank Investment Management (largest sovereign wealth fund in the world, owning 1.5% of 9,000 companies globally), the Council of Institutional Investors, and the UK Executive Remuneration Working Group.

Norges Bank argues that equity-based compensation has not aligned CEO pay with shareholder interests, overall levels of CEO pay do not correlate with company performance and “increasingly complex remuneration takes up considerable time and focus in the relationship between companies and investors” thereby diverting attention from important other company issues.² The Norges position is that long-term incentive plans are ineffective and expensive and put pressure on corporate governance.³

The approach Norges recommends is simple: traditional long-term incentives should be eliminated. Rather, a substantial portion of annual pay should be delivered in restricted stock that vests over the long-term, beyond the typical three-year performance period that some may argue is short term in the business cycle. Norges argues that this simplified approach is more transparent and provides an ongoing alignment of management interests with those of shareholders. While the stated objective is simplification and transparency, the objective may actually be to limit the size of CEO pay by limiting “the prospect of unanticipated and outsized awards that challenge legitimacy” since Norges calls on boards to set a cap on the amount of CEO pay.⁴

Meanwhile, the Council of Institutional Investors, which provides corporate governance insights to a membership of asset owners including pension and retirement funds, has stated it believes performance plans are a “major source of today’s complexity and confusion” and are “susceptible to manipulation.” Therefore, CII argues, the Compensation Committee should consider whether performance shares should simply be replaced with “long-vesting restricted shares” over a period of at least 5 years and preferably as long as ten years, or even into retirement.⁵

Finally, the UK Department of Business, Energy and Industrial Strategy published a “Green Paper” on corporate governance⁶ criticizing the complexity of executive pay which “has contributed to poor alignment between executives, shareholders and the company, sometimes leading to levels of remuneration which are very difficult to justify.”⁷ To remedy this perceived problematic structure, the Green Paper questions whether companies should eliminate LTI programs and merely grant restricted shares that vest over a minimum of 5 years.⁸ Given that time-vesting restricted shares are assumed to have a greater certainty of value when compared to performance-based long-term incentives, the Green Paper solicited comments on whether the grant date value of restricted share awards need only be set at discount of 50% or more of the targeted value of performance-based long-term awards.

CORPORATE PERSPECTIVE

This viewpoint is not without corporate support. A study conducted by PricewaterhouseCoopers which surveyed over 1,000 executives across 43 countries, including the US, found that fewer than half of the participants believed long-term incentives are an effective incentive, although two-thirds valued the opportunity to participate.⁹ Participants preferred current pay, based on internal financial measures they felt they could more directly influence, as opposed to deferred compensation that has a more ambiguous value, even though the potential for gain may be higher.¹⁰ The study recommended “[W]henever possible go for the simpler option – requiring executives to hold shares may be a better approach than plans with complex performance conditions.”¹¹

Unilever, a UK-headquartered company, in 2016 eliminated long-term incentives for its top 500 managers (other than “Executive Directors” such as the CEO and CFO) and instead implemented a co-investment model to drive an “owner’s mindset.”¹² Under the revised approach to incentives, executives were encouraged to invest up to 100% of their annual incentive payouts in Unilever shares. The company matched the participants’ investment based on the performance of the company. The amount of the company match ranged from 0% to 200% of the participants’ share investment and vested over a 4-year period.¹³

Why do that? The stated rationale for this change was to simplify rewards; increase shareholding levels throughout Unilever’s management population; ensure consistent alignment of performance measures with strategy; and increase the timeframe over which incentives are delivered.14 Since the time period over which the incentive is earned matched the time period of the reported performance results, it was easier to communicate to executives.

Further, a co-investment approach ensures the executive risks his or her own money in company shares, creating real alignment with shareholders. In the Unilever Annual Report and Accounts for 2022, the performance metrics for the co-investment plan included not only measures of financial performance but had evolved to include broader stakeholder objectives.15 Drawing on research from behavioral economics, one might expect the incentive effect of investing an executive’s own money to be increased effort to create shareholder value and avoid loss. This research suggests that individuals are more highly motivated to avoid losses than to seek gains, suggesting the co-investment model may help create sustained shareholder value while avoiding excessive risk.16

Revisiting LTI Design

“Executive compensation isn’t broken, but aspects of it should change.” We should assess the extent to which complexity is helping or inhibiting the intended motivational impact of incentives and simplify where possible.

ONE SIZE DOESN’T FIT ALL

Although the call for simplification tends to emphasize the use of restricted shares as the preferred approach to long-term incentives, even Norges Bank points out that one formulation of incentives may not be appropriate for all companies. “Boards must be able to tailor remuneration plans to the challenges of the company and encourage the CEO to take appropriate risk. Boards should be able to reward strategic moves by the CEO, even if the market does not immediately appreciate their significance.17

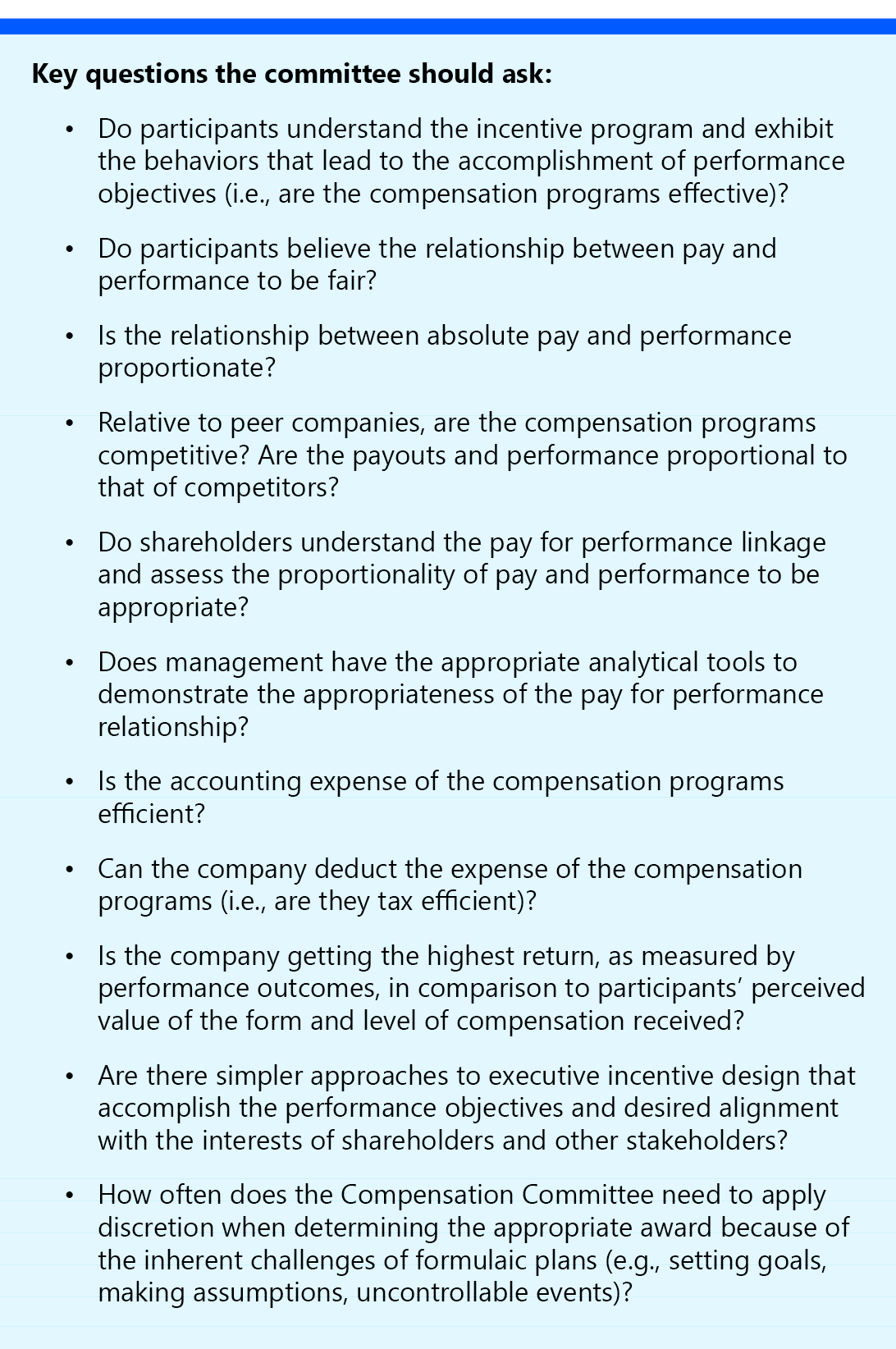

The desirability of tailoring long-term incentives to best meet the company’s objectives would suggest that compensation committees assess the extent to which the current complexity in the company’s long-term incentive design is helping or inhibiting the intended motivational impact of long-term incentive awards. If there is a better approach to incentives that clarifies the pay for performance linkage while maintaining flexibility to accommodate potential changes in strategy and the competitive environment, compensation committees should know about it.

One formulation of incentives may not be appropriate for all companies. If there is a better approach, compensation committees should know about it.

Simplification Opportunities

Should a compensation committee determine that current approaches to executive compensation are overly complex and want to explore alternatives to simplify their designs, here are some examples.

- Eliminate LTI awards and provide only salary and annual incentives, but require a significant portion of the annual incentive to be deferred into restricted stock to negate the potential for short-termism and align with long-term shareholder interests.

- Eliminate LTI and provide only salary and restricted stock, with shares vesting over a multi-year period.

- Grant only one form of performance-based long-term incentive to reduce complexity.

- Grant only stock options that provide a clear pay for performance relationship with shareholder returns.

- Simplify the number of performance measures used in both annual and LTI awards.

Appendix

Major Regulatory and Legislative Changes Involving Executive Compensation

Sources

* Kevin J. Murphy, University of Southern California - Marshall School of Business; USC Gould School of Law, Executive Compensation: Where We are, and How We Got There, last viewed at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2041679.

1 Stanford Graduate School of Business et al., 2015 Investor Survey: Deconstructing Proxy Statements, last viewed at https://www.gsb.stanford.edu/faculty-research/publications/2015-investor-survey-deconstructing-proxy-statements-what-matters.

2 Norges Bank Investment Management, 01/2017 Remuneration of the CEO: Asset Manager Perspective, at 5, last viewed at https://www.nbim.no/contentassets/bc85c448e6b24ff5a31088883695a344/ceo-remuneration---amp-1-17---norges-bank-investment-management.pdf.

3 Id. at 9.

4 Norges Bank Investment Management, CEO Remuneration Position Paper, at 1, last viewed at https://www.nbim.no/en/responsible-investment/position-papers/ceo-remuneration/.

5 Council of Institutional Investors, 3/6/2023 Policies on Corporate Governance, last viewed at https://www.cii.org/corp_gov_policies.

6 The Executive Remuneration Working Group was created by the Investment Association of the UK and issued a report encompassing 10 recommendations arguing that companies should “be given the flexibility to select the right pay structure that works for them and their shareholders, rather than focusing solely on the currently dominant ‘one-size-fits-all’ Long-Term Incentive Plan (LTIP) pay structure.” See “Investment Remuneration Working Group Issues Ten Recommendations to Rebuild Trust in Pay,” July 26, 2016, last viewed at https://www.theia.org/news/press-releases/executive-remuneration-working-group-issues-ten-recommendations-rebuild-trust.

7 UK Department of Business, Energy and Industrial Strategy, Corporate Governance Reform Green Paper, p. 17 (quoting the Final Report of the Executive Remuneration Working Group).

8 See id. at 32-33.

9 PwC, Making Executive Pay Work: The Psychology of Incentives, at 6, https://www.pwc.com/gx/en/hr-management-services/publications/assets/making-executive-pay-work.pdf.

10 Id.

11 See id. at 7.

12 Unilever Annual Report and Accounts 2016, p. 50.

13 See id. at 49.

14 Id.

15 Unilever Annual Report and Accounts 2022, p.118.

16 Richard H. Thaler, Quasi Rational Economics, p. 7 (1991).

17 Norges Bank Investment Management, CEO Remuneration Position Paper, p. 2.

Dr. Charles G. Tharp

Senior Advisor, Research and Practice, Center On Executive Compensation

Contact Dr. Charles G. Tharp LinkedIn

Ani Huang

Senior Executive Vice President, Chief Content Officer, HR Policy Association

Contact Ani Huang LinkedIn